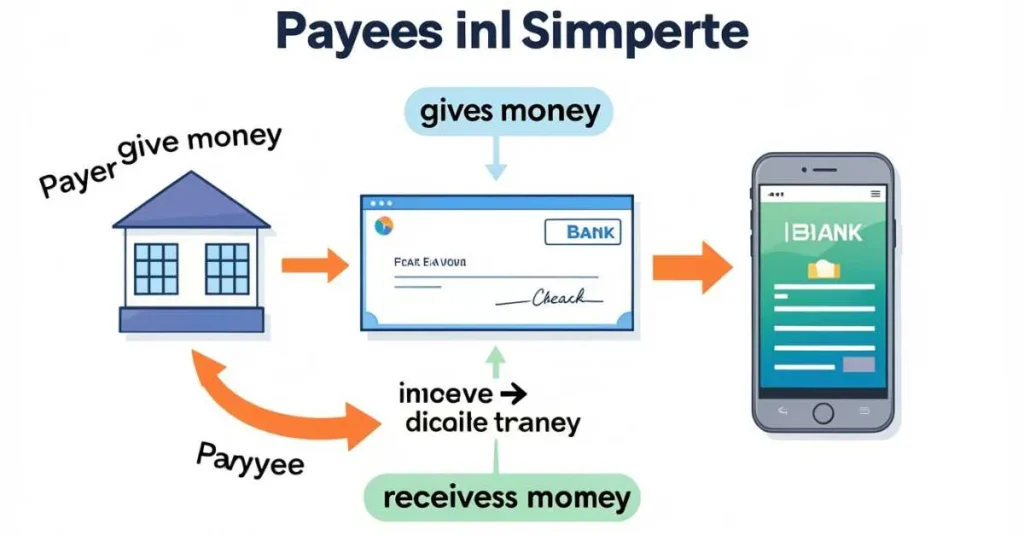

When money is sent from one place to another, two roles always exist. One person sends the money, and another receives it. The person or organization that receives the money is called the payee.

So, what does payee mean?

A payee is the person, business, or organization that legally receives money in a financial transaction. Payees appear in banking, checks, salaries, invoices, digital payments, and legal documents.

Understanding the meaning of payee helps you avoid payment errors, delays, and fraud. It also makes banking and online payments much easier.

This guide explains the payee meaning in simple words, with real examples from banking, checks, and digital payments.

What Does Payee Mean? Clear Definition

A payee is the person or organization that receives money.

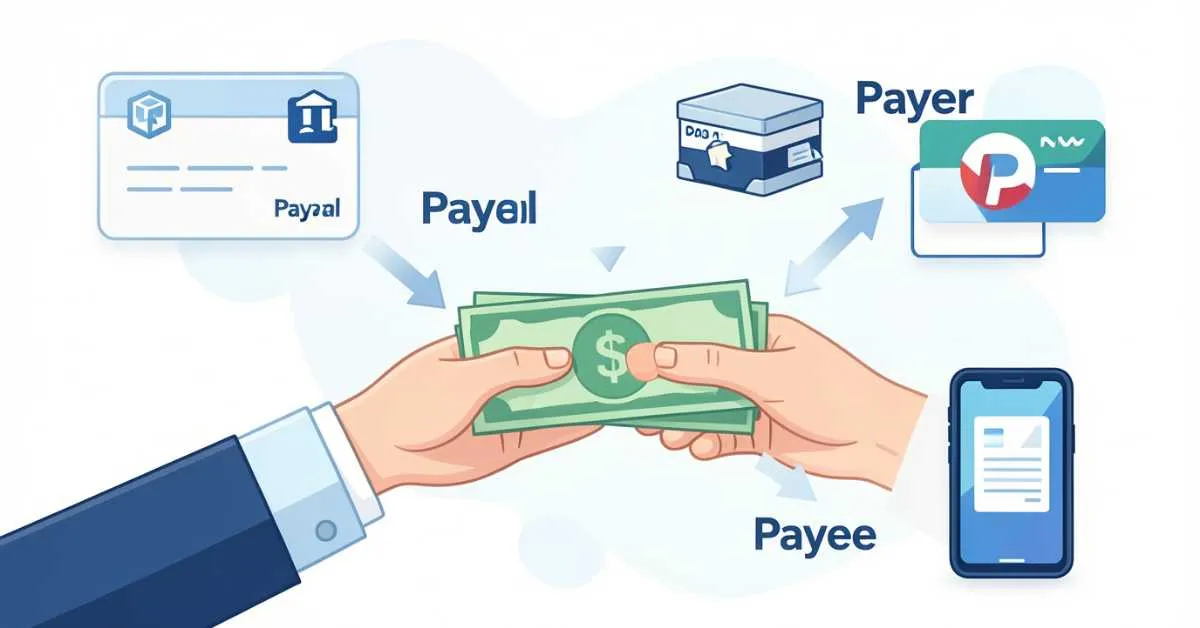

- The payer sends the money

- The payee receives the money

This applies to all types of payments, including cash, checks, bank transfers, and online payments.

Simple example:

- You pay your rent → landlord is the payee

- You receive your salary → you are the payee

In every transaction, the payee is the legal receiver of funds.

Payee Meaning in Simple Words

In simple terms, a payee is who gets paid.

If money comes to you, you are the payee.

If money goes out from you, you are the payer.

You will see the word payee in:

- Banks

- Checks

- Payment apps

- Business invoices

- Legal papers

The payee’s name tells the bank or system where the money must go.

Who Can Be a Payee?

A payee can be any legal entity that receives money.

Common types of payees:

- Individuals – salaries, refunds, personal transfers

- Businesses – shops, vendors, freelancers

- Companies – service providers, employers

- Government agencies – taxes, fees, fines

- Organizations – schools, hospitals, charities

- Banks – loan or mortgage payments

If an entity is legally allowed to receive money, it can be a payee.

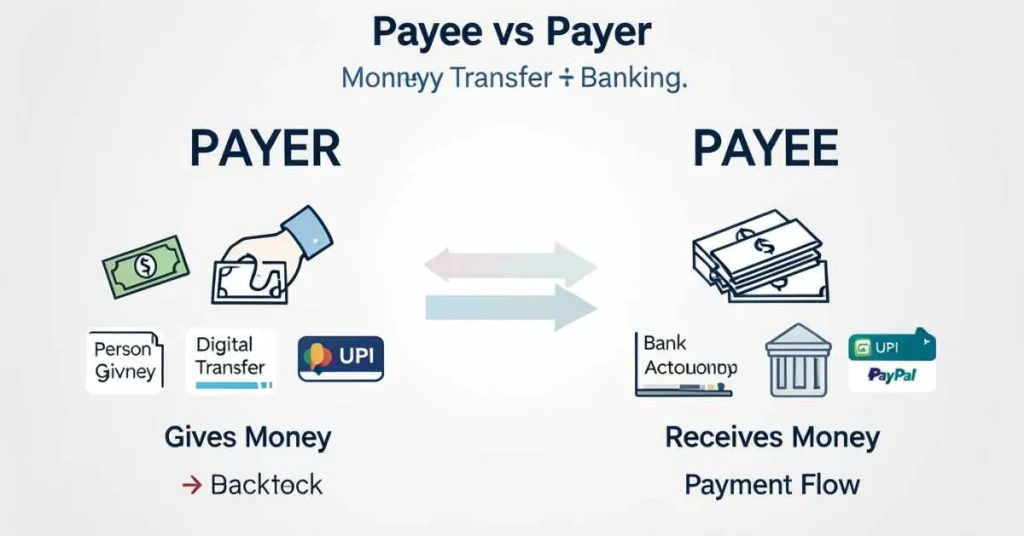

Payee vs Payer (Very Important Difference)

Many people confuse these two terms.

| Term | Meaning | Role |

|---|---|---|

| Payee | Receives money | Payment receiver |

| Payer (Payor) | Sends money | Payment sender |

Example:

- Shopping in a store

- You = payer

- Store = payee

Knowing this difference prevents mistakes in banking and payments.

Payee vs Beneficiary vs Recipient

These words sound similar but are not the same.

- Payee – the official receiver of money

- Beneficiary – receives benefits indirectly (insurance, trust)

- Recipient – general word for anyone receiving something

Example:

- Insurance claim

- Hospital = payee

- Patient = beneficiary

Correct usage matters in legal and financial documents.

Payee in Banking and Finance

In banking, the payee is the person or entity whose account receives money.

Banks require correct payee details, such as:

- Full name

- Account number

- Routing or IFSC code

- Bank name

These details help:

- Prevent fraud

- Avoid failed transactions

- Ensure accurate transfers

Payee information appears in:

- Bank transfers

- Wire transfers

- Direct deposits

- Salary payments

- Loan repayments

Even a small mistake in the payee name can cause delays.

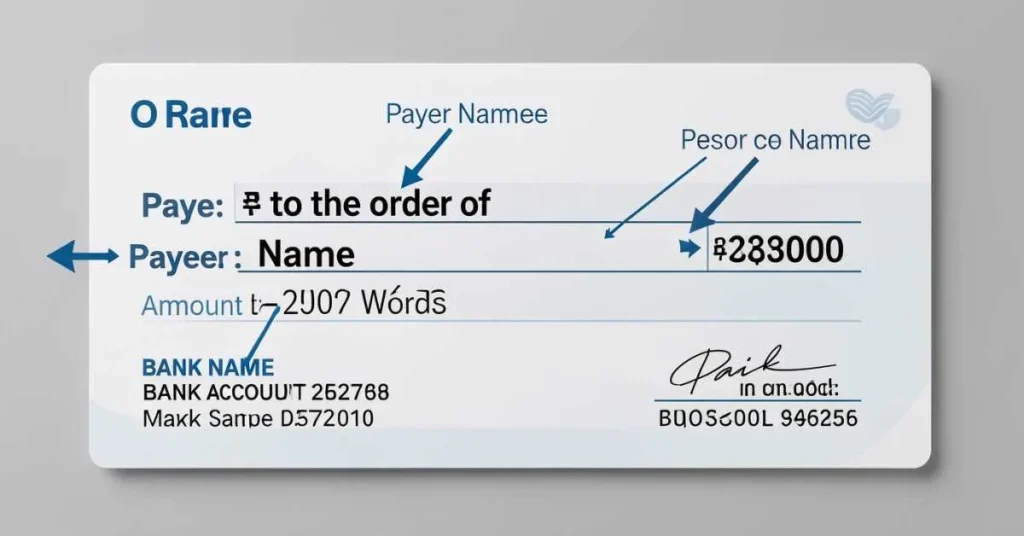

Payee on a Check (How It Works)

On a check, the payee name appears on the line:

“Pay to the order of”

Only the payee can:

- Deposit the check

- Cash the check

- Endorse the check

Multiple payees on a check:

- Alice AND Bob → both must sign

- Alice OR Bob → either can sign

The payee name must be clear and spelled correctly.

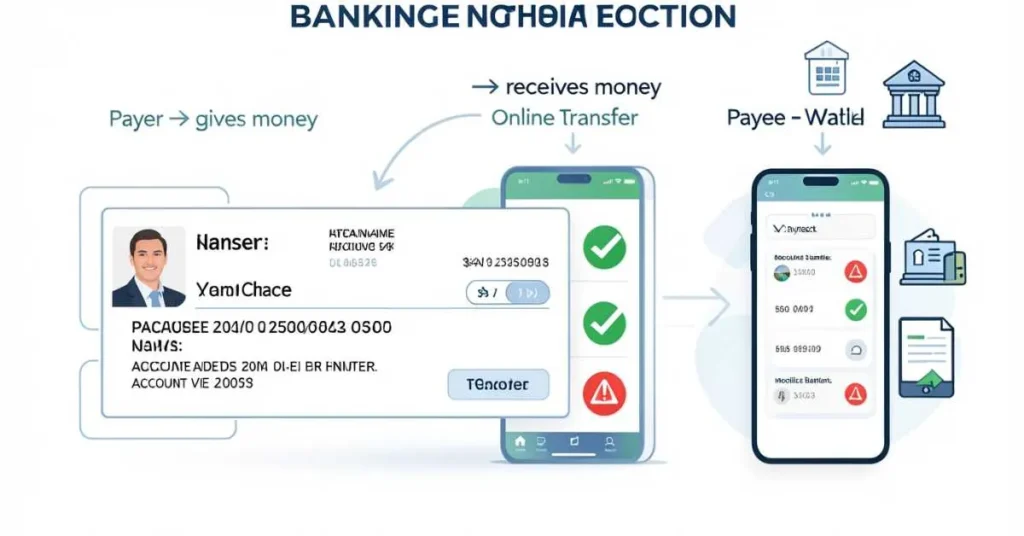

Payee in Digital Payments and Online Banking

In digital payments, the payee is the saved receiver of money.

You add payees in:

- Banking apps

- UPI apps

- PayPal

- Stripe

- Online wallets

How digital payees work:

- Enter payee details

- Verify with OTP or code

- Save payee for future payments

Correct payee setup ensures:

- Fast transfers

- Secure payments

- Fewer errors

Most banks delay new payees for security reasons.

Why Accurate Payee Information Is Important

Incorrect payee details can cause serious problems.

Common issues:

- Returned payments

- Failed bank transfers

- Lost money

- Fraud risk

- Legal disputes

Always double-check:

- Payee name spelling

- Account number

- Bank details

- Email or phone number (for apps)

Accuracy protects both payer and payee.

How to Add or Change a Payee

To add a payee:

- Enter full legal name

- Add correct account details

- Verify via OTP or security step

To edit a payee:

- Update details

- Re-verify identity

- Wait for bank approval

Banks often add waiting periods to stop fraud.

Legal Meaning of Payee

Legally, a payee is the party entitled to receive money under law or contract.

Legal examples:

- Loan payee → bank

- Insurance payee → hospital or company

- Court settlement payee → injured party

- Salary payee → employee

Legal documents clearly name the payee to avoid disputes.

Real-Life Examples of Payee

- “My employer is the payer, and I am the payee.”

- “The landlord is the payee on the rent check.”

- “Add the electricity company as a payee.”

- “The hospital is the insurance payee.”

These examples show how payees appear in daily life.

Common Payee Problems (And Solutions)

Problems:

- Wrong name

- Duplicate payees

- Fake payees

- Payment delays

Solutions:

- Verify details before sending

- Use official names

- Avoid unknown payees

- Confirm with the receiver

Small checks prevent big losses.

Payee Summary Table

| Term | Meaning | Used In |

|---|---|---|

| Payee | Receives money | Banking, checks, apps |

| Payer | Sends money | Payments, transfers |

| Beneficiary | Receives benefits | Insurance, trusts |

| Recipient | General receiver | Casual use |

FAQs About Payee

What does payee mean in banking?

The person or entity receiving money.

Is the payee the sender?

No. The payee is the receiver.

Can a company be a payee?

Yes, any legal entity can be a payee.

What if the payee name is wrong?

The payment may fail or be returned.

Is payee the same as beneficiary?

No. A beneficiary may receive money indirectly.

Final Thoughts: What Does Payee Mean?

A payee is the receiver of money in any transaction. From checks and bank transfers to salaries and digital payments, the payee plays a central role in finance.

Knowing what a payee means helps you:

- Send money safely

- Avoid errors

- Prevent fraud

- Manage payments confidently

Always verify payee details before sending money. Clear payee information ensures fast, secure, and successful transactions.

Click Here To Read About: What Does Assimilate Mean? Usage, Context & FAQs

Hi, I’m Geoffrey Chaucer. I explore the stories and meanings behind words, turning ideas into clear, insightful writing. Through every article I craft, I aim to spark curiosity, share knowledge, and help readers uncover practical, meaningful truths in everyday life.